In Connecticut and Massachusetts, Inflation Hits your Local Tax Bill

In the past ten years, more residents moved out of Connecticut and Massachusetts than moved in(1), due in part to high taxes and the prospect of higher taxes in the future. Connecticut experienced a dramatic uptick in migration outflow that peaked in 2019 and has since levelled off. Massachusetts’s outflow was less pronounced but peaked in 2021 and has since levelled off as well. The uptick in outflows were likely due to COVID, but now that COVID is behind us, what has happened to the taxes that caused so many to move away?

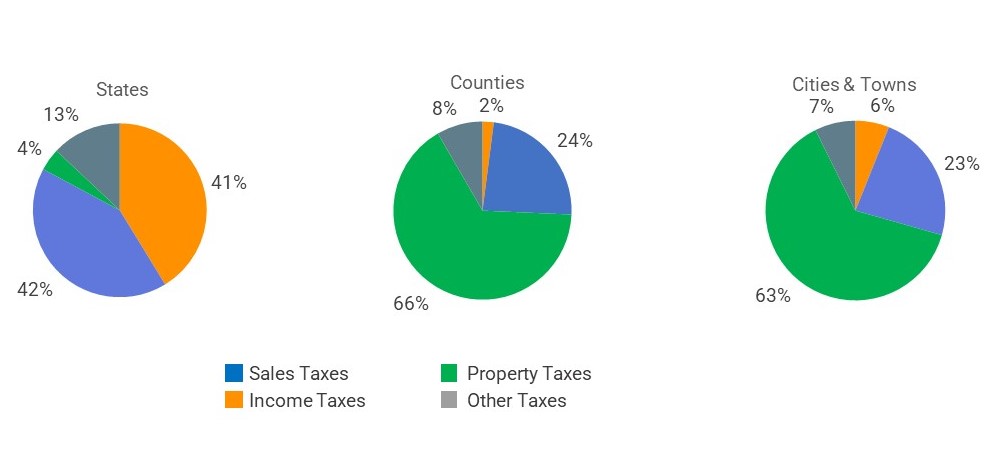

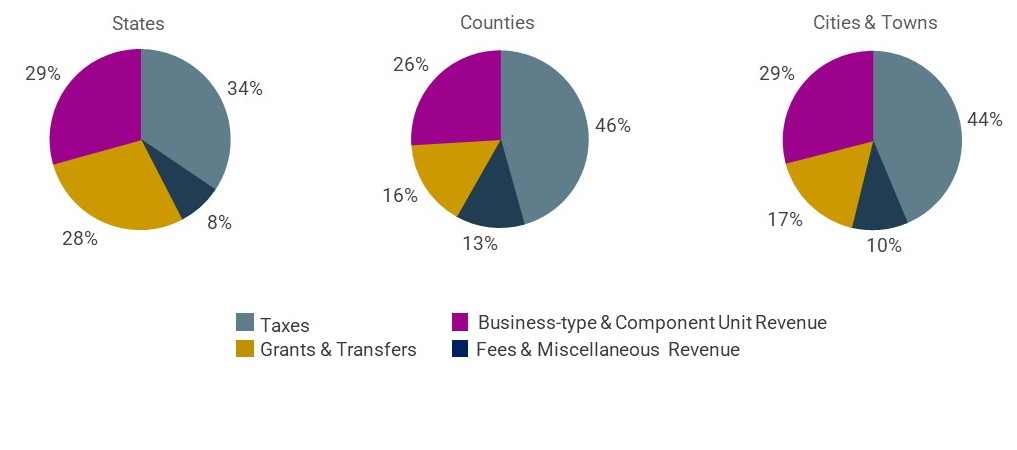

At Pality, publisher of TownScoreReport.com, we examine the change in local taxes paid by residents in Connecticut and Massachusetts from 2018 to 2023. This period covers the time from before COVID to after COVID. We capture all taxes and fees paid to local governments, such as property taxes, including those on cars and other personal property, special assessments, other taxes, fees and other government revenue derived from taxpayers.

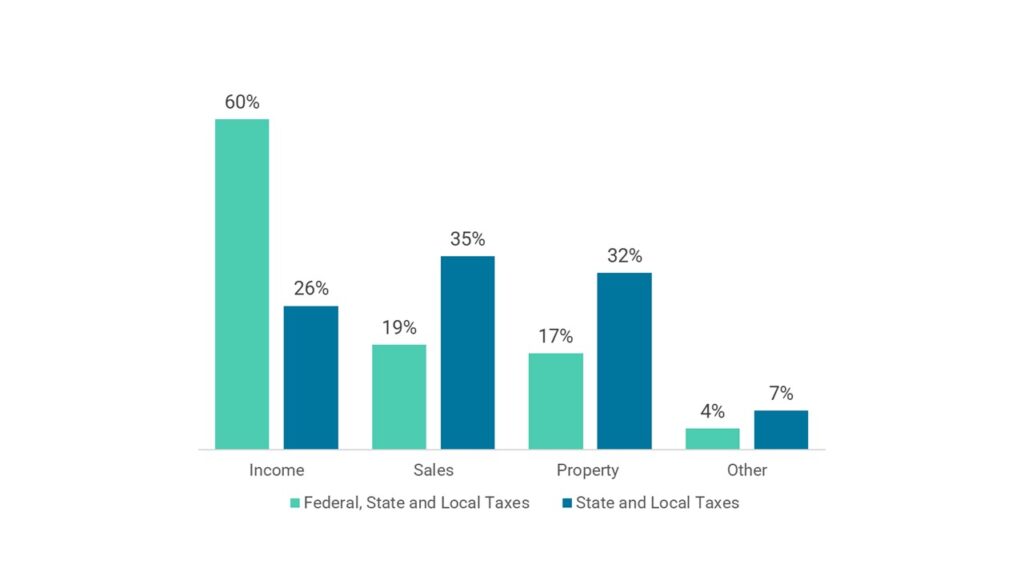

We measure the change in taxes and fees in three ways: First, in dollars per household, and we compare this to inflation to observe whether the taxes increased in “real” terms, meaning on an inflation-adjusted basis.

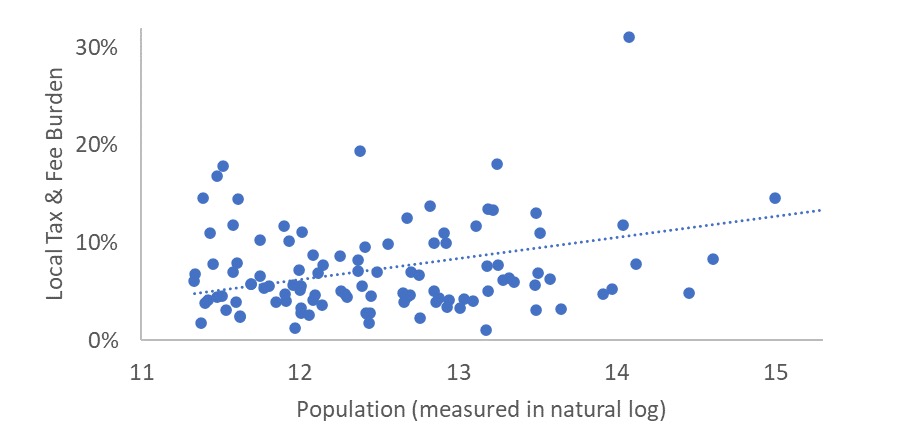

Second, we measure “tax burden,” which is taxes and fees as a share of taxpayers’ income, to observe if local governments are taking more or less out of their taxpayers’ wallets.

And third, we measure taxes and fees as a percent of the market value of the median home in the city or town, which we call the “effective” property tax rate.

We aggregate the experience across households in the 169 cities and towns in Connecticut and across the 351 cities and towns in Massachusetts. The aggregation illuminates the local tax experience of the average taxpaying household in each state. Any given household’s experience can deviate significantly from the average. For example, one’s property assessment can rise more than average or one’s income can rise less than average, either of which will make the impact from taxation more severe than the averages presented here.

Which state had the largest increase in local taxes?

Percent Change in Local Taxes and Fees, Dollars per Household, 2018 to 2023:

Connecticut: + 23.0%

Massachusetts: + 27.8%.

From fiscal year 2018 to fiscal year 2023, households in Connecticut and Massachusetts saw significant increases in local taxes, rising 23% in Connecticut and 28% in Massachusetts. During this period, inflation was also at historical highs, with the price level increasing 21%. In “real” inflation-adjusted terms, local taxes and fees per household increased only slightly in Connecticut but nearly seven percent in Massachusetts. In both states, the absolute dollars paid per household rose considerably, outpacing the historically high inflation and compounding the impact of higher prices for everyday goods and services shouldered by households.

Which state had the largest increase in tax burden?

Percent Change in Local Taxes and Fees, Share of Household Wallet, 2018 to 2023:

Connecticut: – 8.0%

Massachusetts: – 10.3%.

While the total dollars that cities and towns collected from their residents increased in both states, in the aggregate and per household, average household incomes rose even faster during the period. In Connecticut, household income rose by 34% while taxes and fees flowing to the local governments grew somewhat less, by 23%. As a result by 2023, the local tax burden decreased by 8%. That is, local taxes and fees took 8% less out of the average Connecticut taxpayer’s wallet compared to 2018.

In Massachusetts, household incomes rose even faster over the five-year period, at 43%. This increase comfortably outpaced the 28% growth in local taxes and fees, resulting in local taxes and fees taking about 10% less out of the wallet of the average Massachusetts taxpayer than in 2018. Note that while incomes rose considerably in both Connecticut and Massachusetts, on an annualized basis, after adjusting for inflation, real household incomes rose in the two states by 2.1% and 3.5%, respectively.

Which state had the largest increase in the effective property tax rate?

Percent Change in Local Taxes and Fees, as Percent of Home Value, 2018 to 2023:

Connecticut: – 11.0%

Massachusetts: – 10.9%.

Since 2018, median house prices increased 38% in Connecticut and over 43% in Massachusetts, significantly outpacing inflation. Local taxes and fees, while also rising more than inflation, increased by less than home values. As of 2023 in both states, local taxes and fees represent a smaller percent of the market value of homes compared to 2018. This “effective” property tax rate fell by about 11% in both states.

Summary

In summary, the local tax experience for the average taxpayer in Connecticut and Massachusetts has been mixed.

In both states, the total amount of dollars paid to local governments increased by even more than the historically-high inflation, so in real terms, households now pay more. On top of higher prices for everyday goods and services, taxpayers also have to pay more to their local governments. Moreover, in both states, absolute dollars of local taxes and fees ought to have declined or at the very least, risen more slowly than they did given that schools represent the biggest component of local government spending in the two states. School enrollments fell by 3.9% in Connecticut and 3.6% in Massachusetts during the period, while the populations in each state rose by only 1.2% and 1.4%, respectively, notwithstanding net migration outflows.

And while local taxes and fees fell as a percent of average household income, taxpayers whose income growth did not keep pace with the average, such as retirees on fixed incomes, saw their burdens increase. Similarly, while home prices have increased faster than local taxes, a higher market valuation of one’s house does not pay the tax bill in either state. As for how local governments in Connecticut managed their tax impact compared to local governments in Massachusetts, the two states are at parity. Connecticut cities and towns performed less onerously than Massachusetts cities and towns because the absolute dollar amount of taxation rose by less. At the same time, tax burdens declined more in Massachusetts, but this was largely due to higher income growth, which is independent of the management of city or town, at least in the short run.

(1) https://www.unitedvanlines.com/newsroom/movers-study-2023.

Source: Pality, other than what is noted above. Copyright, Pality, 2025.