Municipal Pay and Benefits: High Value, Low Awareness

Municipalities are finding it hard to find qualified candidates to fill jobs. Part of the challenge is due to the perception of low pay relative to the private sector. However, while base salaries may be lower in the public sector for comparable work, the total compensation package in the public sector can be more generous because of benefits. Coupled with significantly more job security than the private sector offers, public sector jobs offer a hidden source of value.

Municipalities understand the value of their total compensation packages. However, the monetary value of benefits is not always visible to employees or prospective employees. Not only may the hiring municipalities not provide transparency into the monetary equivalent of the benefits, unions that negotiate compensation packages on behalf of their members also may not provide transparency.

Employers and unions may not display the monetary value of the benefits in easy-to-understand terms because they reflect value realized in the future and conditional upon retirement age, family dependents, life expectancy, and health. However, straightforward actuarial calculations can yield estimated expected values associated with all benefits. We perform such calculations here to illuminate the value of public sector employment contracts.

Data and Calculations

Our calculations are based on contract data available through 2024 from a representative sample of 30 cities and towns in Connecticut for police officers, which represent the largest municipal employee group after teachers. Our objective is to not conclude that total compensation is sufficient or insufficient for any given employee group. Police officers in particular face significant occupational risk. This makes their hiring even more challenging, and their total pay package may not provide enough compensation for the risk of serious injury. However, this analysis shows that the monetary value of their benefits represents nearly half of the total compensation package, meaning the benefits essentially double the value of the pay.

We perform calculations for two representative cohorts of employees: Seasoned Employees and New Hires. For Seasoned Employees, our calculations on going-forward pay and benefits are based on an employee with ten years of service.

Pay for both New Hires and going-forward pay for Seasoned Employees is calculated based on contractually guaranteed step-ups for longevity and education and a 2.5% annual increase in base pay. For contracts that require less than 2,080 hours of work, time-off is valued as pay that could be earned at a 1.5x overtime rate. Other than valuing contractual time-off relative to 2,080 annual hours, overtime is not included in this analysis, and overtime is a large source of take-home compensation for this labor group in particular.

Each municipality’s health insurance has been valued based on contractual deductibles, copays, and limits and eligible family members and we capture the employer’s going-forward contributions until the expected date of retirement. For Social Security and defined benefit pension benefits, we capture all past and future payments made by the employer since these payments fund future benefits. For Other Post-Employment Benefits (OPEB, which is predominantly retiree health insurance) and defined benefit pension plans, we measure the present value of required employer contributions needed for benefit payments in retirement using a 5.5% discount rate. Medical cost inflation is included for OPEB, and where contractually provided, cost-of-living-adjustments for pensions.

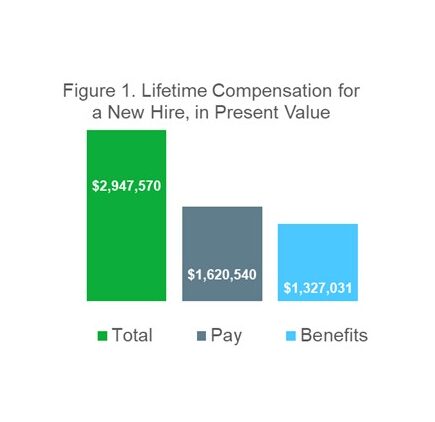

Total Compensation, See Figure 1.

Just how much is a compensation package worth? For a New Hire, with 25 years of expected service and a life expectancy of 85 years, the employee will receive pay and benefits that total, in present value, $2.95 million. This figure represents the average across towns in the sample. The Total Compensation breaks down into $1.62 million of base pay and $1.33 million of benefits, including the value of time-off. For the highest paying city or town in the state, the Total Compensation package for a New Hire is worth $3.42 million. For a Seasoned Employee who already has ten years of service, the total compensation on a going-forward basis is $2.2 million in present value, for the average city or town.

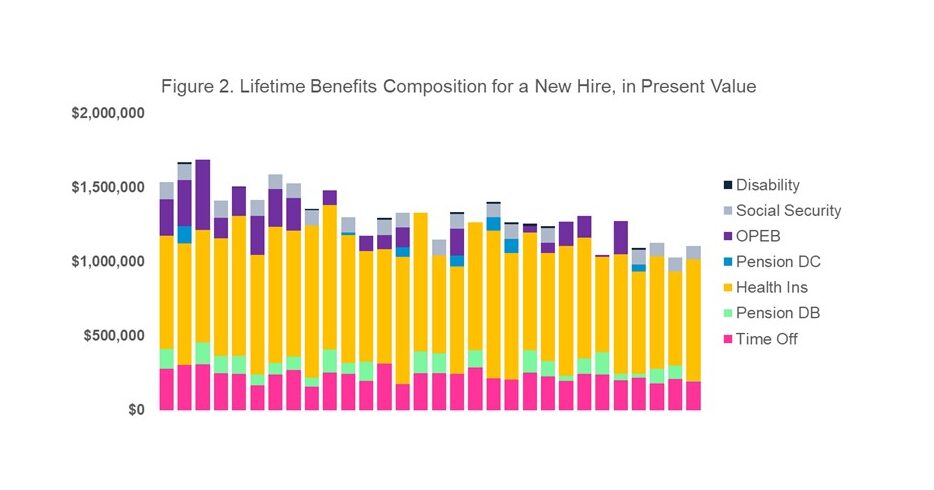

Benefits, See Figure 2.

Benefit packages vary widely across municipalities. While all cities and towns offer time-off and health care while employed, not all provide health care in retirement or a Social Security supplement. Some cities and towns offer a defined benefit pension plan, others offer a defined contribution pension plan, and some offer both or a hybrid plan. The composition of the benefits can be seen below in Figure 2 for the 30 cities and towns in the sample. Health insurance is the largest component of the benefits package. Note that retirement health care is almost unheard of in the private sector. The value of time-off is next in value, but a distant second place to health care. OPEB is the next most valuable benefit, which is more valuable than the pension benefit. Note that the values of pension, OPEB, and health insurance represent only what the employer contributes, and exclude the employee’s contributions. While Figure 2 shows the benefit mix town-by-town for a New Hire, health care has a relatively smaller value for a Seasoned Employee since the employee has fewer years of work remaining.

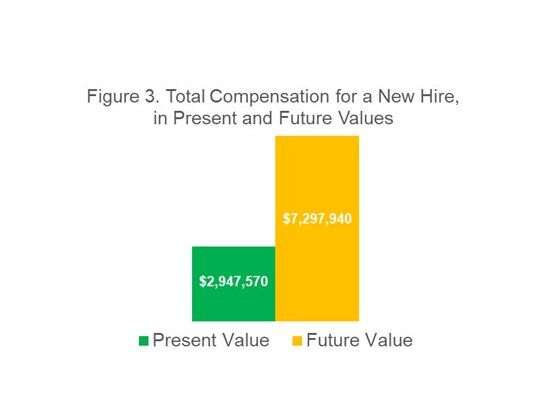

Present Value vs. Future Value, See Figure 3.

The total amount of payments that a municipality will pay out in total compensation is known as the “future value” of total compensation. However, this amount mixes payments made at various times in the future, which are not comparable to each other. Therefore, we add together the payments made in the future using “present value,” which is a common yardstick. Present value represents the dollars that a municipality would need today, so that with investment growth, there would be adequate funds for the employee’s pay and benefits over all future periods. In Figure 3 below, we show Total Compensation for a New Hire in both Present Value and Future Value.

Summary

The public sector offers another very tangible source of value, which is job security. Over one’s career, the chance of being unemployed for a year or more is 22%.1 This statistic is significantly reduced for a public sector worker. The private sector worker not only has a greater chance of lost pay, but also faces diminished wages once re-employed.

Municipalities offer jobs with good work-life balance, generous benefits, and job security. Like many employers, they face challenges attracting and retaining talent. A tangible compensation summary, sketched out in Figures 1, 2, and 3 below may help cities and towns address these challenges.

Municipalities offer good work-life balance, generous benefits, and job security. Like many employers, they face challenges attracting and retaining talent. A tangible compensation summary, sketched out in Figures 1, 2, and 3 may help cities and towns address these challenges.

[1] Donna S. Rothstein, “An analysis of long-term unemployment,” Monthly Labor Review, U.S. Bureau of Labor Statistics, July 2016, https://doi.org/10.21916/mlr.2016.32″